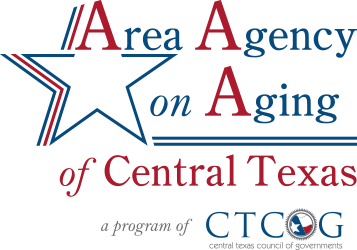

Alzheimer’s Association and AAACT Expand Support Group Offerings in Central Texas

Support groups are available for those affected by Alzheimer’s and other dementia CENTRAL TEXAS – In a partnership between the Alzheimer’s Association Capital of Texas Chapter and the Area Agency on Aging of Central Texas, a new support group in Killeen will join existing support groups in Temple, Belton, and Lampasas. These support groups, which are open to all, will expand in the future to other counties served by AAACT. Alzheimer’s Association support groups, conducted by trained

Celebrating Caregivers Conference to be Held in Belton on November 9

The Event Will Feature a Day of Education, Resources and More BELTON, TX – The Alzheimer’s Association Capital of Texas Chapter is joining The Area Agency on Aging of Central Texas to present the Celebrating Caregivers Conference on Wednesday, November 9, during National Family Caregivers and Alzheimer’s Disease Awareness Month. Area residents are invited to celebrate with a day of learning, resource sharing and more. The event is free to

Free Respite Service for Caregivers Seeking Participation

The Thursday Club is a FREE weekly respite service where we treat your loved one with a home-cooked meal, entertainment, and one-on-one interaction! We meet from 9am - 1pm at the First Lutheran Church in Temple. The Thursday Club is an amazing ministry run by volunteers and nursing professionals. Here's how it works. You drop off your loved one at 9:30 am so that you, the caregiver, can do something for

New Support Group Available for Caregivers of people with Alzheimer’s or Dementia

Fifty-nine percent of family caregivers of people with Alzheimer’s or other dementias rated the emotional stress of caregiving as high or very high LAMPASAS, TX – In partnership with the Alzheimer’s Association Capital of Texas Chapter and the Area Agency on Aging of Central Texas, Texas A&M AgriLife Extension is hosting a Caregiver Support Group on the third Friday of each month at 10 a.m. The new support group begins May

Great Reviews for Powerful Tools for Caregivers Class

We recently finished another self-management class, Powerful Tools for Caregivers, and we had some great responses on our class reviews. When asked to rate the class overall on a scale of 1 to 10, the reviews received a 9.625 average rating. Here are a few of the responses when asked what they liked about the class: "One of the most delightful parts of the class has been the sharing of teachers