Medicare Open Enrollment Period Kicks Off Today

People with Medicare can Review their Drug and Health Plan Options through December 7, 2021 Today, the Centers for Medicare & Medicaid Services (CMS) is reminding people with Medicare that Medicare Open Enrollment begins October 15, 2021, and now is the time to review their coverage options and make a choice that meets their health care needs. Medicare’s Open Enrollment period gives those who rely on Medicare the opportunity to make

Understand the Benefits Offered by the Medicare Savings Programs

MSPs help pay your Medicare costs if you have limited income and savings. There are three main programs, each with different benefits and eligibility requirements: Qualified Medicare Beneficiary (QMB) Specified Low-Income Medicare Beneficiary (SLMB) Qualified Individual (QI) Benefits of Qualified Medicare Beneficiary (QMB) Pays Part A & B premiums. Eliminates cost-sharing for Medicare-covered services. Gross Monthly Income Limit: Individuals $1,094; Couples $1,472 Asset Limit: Individuals $7,970; Couples $11,960 Benefits of Specified Low-Income Medicare Beneficiary (SLMB) Pays

Medicare Minute August 2021

Common Open Enrollment Notices You can make changes to your Medicare coverage each year during Medicare’s Open Enrollment Period, which runs October 15 to December 7. Around September, you will start to receive notices with information about any changes to your coverage for the coming year. It is important to read and understand these notices, as they can help you decide if you should make changes to your coverage during Medicare’s

Six Things to Know About Fall Open Enrollment for Medicare

Fall Open Enrollment is the time of year when you can change your Medicare coverage. You can: Join a new Medicare Advantage Plan or stand-alone prescription drug (Part D) plan Switch between Original Medicare with or without a Part D plan and Medicare Advantage Listed below are six things to keep in mind while you are choosing your Medicare coverage. Fall Open Enrollment occurs each year from October 15 through December

Understand Your Medicare Coverage Choices

You have options when it comes to how you get your Medicare coverage. The two main ways are Original Medicare or Medicare Advantage. When choosing which coverage is right for you, consider: COST Original Medicare: You pay a monthly Part B premium, and any copayments, coinsurances, and deductibles. There is no limit to how much you can pay out of pocket, but you can buy a Medicare Supplement Insurance (Medigap) policy to help.

Genetic Testing Fraud Targets Older Adults

Protecting Yourself and Your Medicare Coverage Article by Texas Senior Medicare Patrol Genetic testing scams are currently a widespread issue throughout the country. Scammers are offering Medicare beneficiaries cheek swabs for genetic testing to obtain their Medicare information for identity theft or fraudulent billing purposes. What is Genetic Testing Fraud? Genetic testing fraud occurs when Medicare is billed for a test or screening that was not medically necessary and/or was not ordered by a

Protecting Seniors from Health Care Fraud

Health Care Scams Cost Medicare Beneficiaries Billions Article by Senior Medicare Patrol The Medicare program and Medicare beneficiaries lose an estimated $60 to $90 billion each year to health care fraud as older adults are increasingly targeted by scam artists. This fact sheet provides basic information and tips you can use to help prevent health care fraud in your facility. Senior center and senior housing staff are in a unique position to help

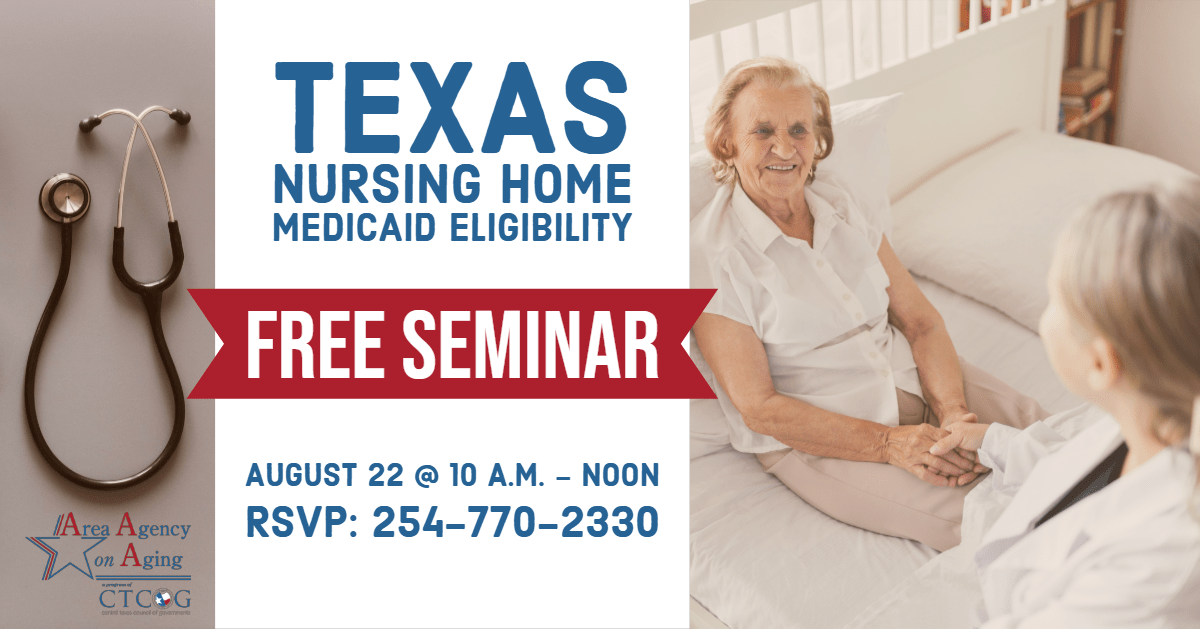

Texas Nursing Home Medicaid Eligibility – Free Seminar

If you need assistance with long-term care costs, Medicaid coverage may be available. Learn about the eligibility requirements for Medicaid Long-Term Care, transfer of assets, spousal protections, and more at this free seminar. Guest speaker is attorney Cara M. Chase from Naman, Howell, Smith & Lee, PLLC. Please RSVP to this free event at 254-770-2330 or 254-770-2342. The event will be held on August 22, 2019, at 10 A.M. to noon,

Welcome to Medicare! Free Seminar

Learn the differences between types of Medicare coverage, prescription drug coverage, Medicare Advantage, and more at the Welcome to Medicare seminar. Guest speaker is Sheryl Schroeder, Public Affairs Specialist at the Social Security Administration - Dallas Region. If you have Medicare and are lost when it comes to your coverage, or if you are looking to enroll and don't know where to start, this seminar is for you! The event will